Currency Traders Anticipate Yuan Reference Rate Amid Tariff Concerns

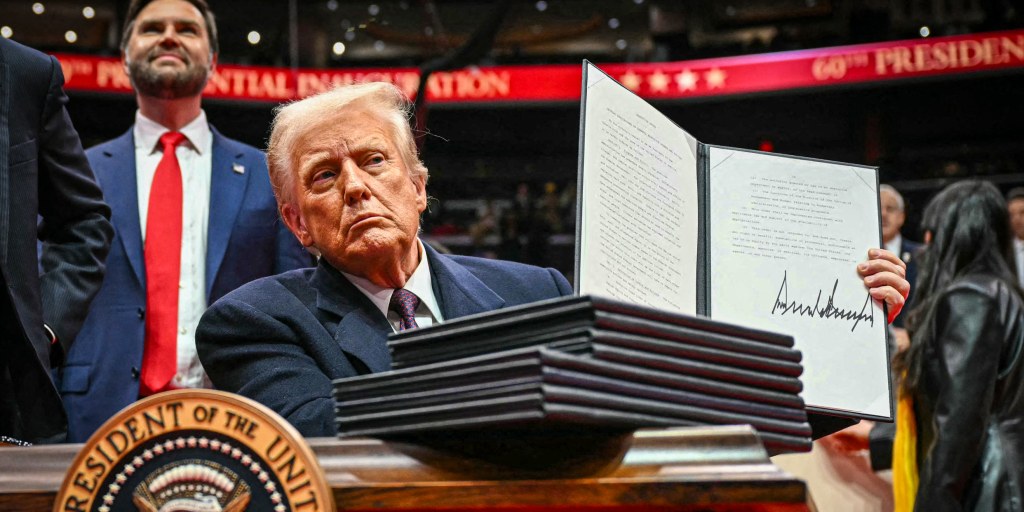

Traders are eager for the next yuan reference rate as expectations grow for a potential weakening, particularly if tariffs from Donald Trump are implemented.

Currency traders are waiting with bated breath for China's next daily reference rate for the yuan, with some expecting authorities to relax their tight grip if Donald Trump's tariffs go into effect.

The People's Bank of China may set the so-called fixing weaker than 7.2 per dollar, according to Australia & New Zealand Banking Group and Malayan Banking Bhd., with the former expecting a breach this week. The level has been tightly guarded by the PBOC since November, when Trump's election win spurred the managed currency's slide.

:max_bytes(150000):strip_icc():focal(749x0:751x2)/broccoli-recall-02032025-6-e705644b4e384e1ab61eb00a0625f736.jpg)